What is the Consumer Duty?

The Duty aims to ensure a greater level of consumer protection within the retail financial markets and higher expectations for the standard of care that firms provide to consumers. It applies to all FCA regulated, exempt and ancillary activities on, in or from the UK, where the end client is a retail client, SME or small charity, including our authorised electronic money and payment services.

Unregulated activities are not in scope of the Consumer Duty.

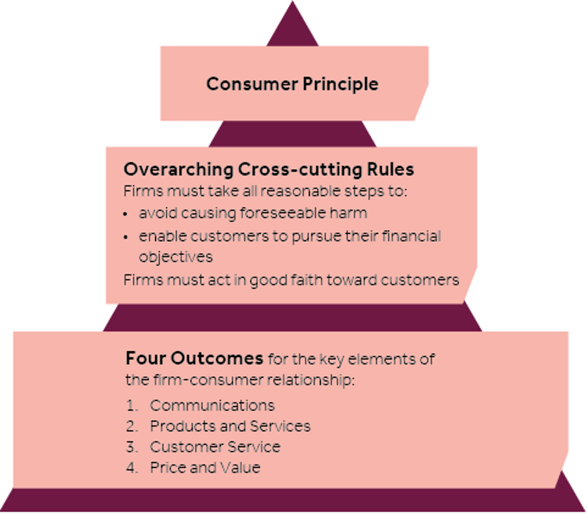

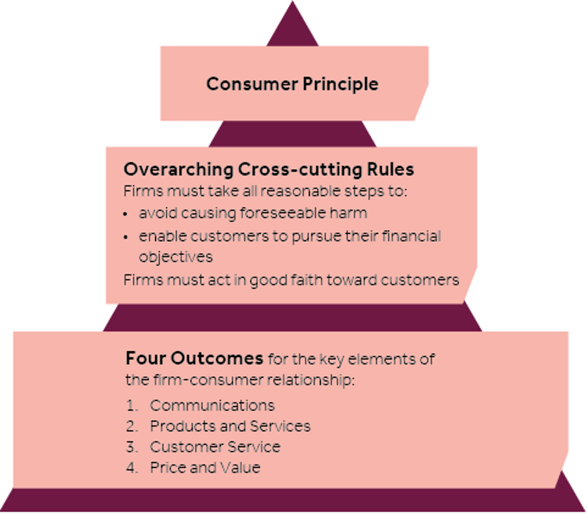

The Duty is comprised of 3 key elements:

1. The Consumer Principle

Principle 12 – Firms ‘must act to deliver good outcomes for retail clients’

This new principle, which will be added to the FCA Handbook, reflects the FCA’s expectation that firms should ‘consistently focus on consumer outcomes and put consumers in a position where they can act and make decisions in their own interests’. Firms should aim to identify where good outcomes are not being achieved and take the appropriate action to address this.

2. Cross-cutting Rules

The rules outline three key behaviours expected from firms:

- Act in good faith – acting honestly, fairly, openly and consistently with the reasonable expectations of consumers.

- Avoid foreseeable harm – firms should not cause harm to consumers through their conduct, products or services and should be proactive in avoiding it.

- Enabling retail customers to pursue their financial objectives – consumers should be empowered to make their own choices and remain responsible for their decisions and actions. However, the FCA expect firms to take responsibility for establishing an environment where consumers can act in their own interests.

3. The Four Outcomes:

The outcomes represent key elements of the firm-consumer relationship and are the main focus in delivering good outcomes for consumers. They provide more detail into the conduct expected of firms within these four areas:

- Products and Services

- Price and Value

- Consumer Understanding

- Consumer Support

How Consumer Duty affects firms across the four outcomes

Products and Services

Products and services must specifically be designed to meet the needs of consumers and sold to those whose needs they meet. The requirements of manufacturers and distributors are specific to their role in the distribution chain.

Manufacturers are described by the FCA as firms who create, develop, design, issue, manage, operate, carry out or underwrite a product or service.

Distributors are firms that offer, sell, recommend, advise on, propose or provide a product or service.

The table below provides an overview of responsibilities relating to both manufacturers and distributors:

| MANUFACTURERS |

DISTRIBUTORS |

- Maintain, operate and review a process for the approval of a product or adaptions to a product.

- Product approval procedures must:

- Specify the target market at a granular level

- Consider vulnerable customers in the target market

- Assess all relevant risks to the target market (including vulnerable customers)

- Ensure the design of the products meets the needs of target market and avoids causing foreseeable harm to them

- Ensure distribution strategy is appropriate for target market

- Ensure product is distributed to the target market

- Assess and regularly review closed or existing products to ensure it meets the above criteria

- If a product adversely affects retail customers, manufacturers must take appropriate action to mitigate harm and inform the relevant persons in the distribution chain

- Test products appropriately and take the relevant action depending on the results

- If collaborating on the manufacture of a product, have a written agreement outlining their respective roles and responsibilities

- Select distribution channels that are appropriate for the target market

|

- Maintain, operate and review product distribution arrangements for each product it distributes that:

- Mitigates/avoids causing foreseeable harm

- Meets the needs, characteristics of the target market

- Has proper management of conflicts of interest

- Contains sufficient, adequate, and reliable information from the manufacturer about the product

- Must provide manufacturers with relevant information (including sales information, data on the review of product distribution) to support their product reviews

- Regularly review distribution arrangements to ensure they are appropriate

- Understand the products/services distributed

- If any issues are identified, it must make the appropriate amendments and inform the relevant persons

|

Price and Value

This outcome reflects the FCA’s expectation that the price of products and services offered by firms, should represent fair value for all consumers. Fair value is defined as when the amount paid for the product is reasonable, relative to the benefits of the product. However, fair value goes beyond the price paid, as it aims to mitigate unsuitable features of a product that can lead to foreseeable harm or tackle features that are unfair or can result in poor value.

| MANUFACTURERS |

DISTRIBUTORS |

- Ensure products provide fair value to the target market

- Conduct a value assessment of its products and regularly review this. The assessment must consider the:

- Benefits consumers expect

- Financial and non-financial costs involved in a product/service

- Characteristics of retail customers

- Ensure distributors have the necessary information to understand the value a product provides

- If a product is identified as not providing fair value, the appropriate action is required

|

- Obtain relevant information from manufacturers to understand the value a product/service provides

- Consider the fair value assessment when determining the distribution strategy

- Regularly review its distribution arrangements throughout the product life, to ensure it is consistent with the product providing fair value to the target market

- Ensure their own charges for distributing the product/service represents fair value

- If a product is identified as not providing fair value, the appropriate action is required (dependent on the role of the distributor in the distribution chain

|

Consumer Understanding

Communications should equip consumers to make effective, timely and properly informed decisions about financial products and services. Consumers can only be expected to take responsibility where firms’ communications enable them to understand their products, services, features and risks and the implications of their decisions. Firms are expected to support consumers in making informed decisions.

This outcome builds on the Consumer Principle 7: firms should communicate in a way which is clear, fair and not misleading.

This is relevant to all firms involved in the production, approval and distribution of consumer communications.

Firms must:

- Act in good faith and avoid producing communications that exploits consumers’ understanding and behaviour

- Ensure that communications are layered, engaging, relevant, simple and well timed

- Ensure that regardless of the channel used for communication, the information enables customers to assess whether the available options meet their needs and objectives

- Ensure that communications are tailored to the appropriate target market

- Ensure communications are understood by the intended recipients and enables them to evaluate their options by assessing the benefits, risks and costs

- Adopt good practices to enhance the clarity of their communications

- Test communications (where appropriate) and monitor the impact of communications to identify if they support good consumer outcomes.

Consumer Support

This outcome expects the service provided to consumers to meet their needs, enable them to realise the benefits of products and services and act in their own interests without unreasonable barriers. Consumers should be supported in an adequate and effective manner throughout the lifecycle of a product or service.

The Consumer Understanding and Consumer Support outcomes should be at the forefront of all interactions with consumers.

This is relevant to all firms who interact directly with or support retail customers regardless of the channel used.

Firms must:

- Provide support that meets the needs of retail customers (including those with vulnerabilities) and avoids causing foreseeable harm

- Ensure their customer support does not impose unreasonable additional barriers, costs, delays, distress or inconvenience to the consumer

- Consider their monitoring activities to ensure their post-sale support is as good as their pre-sale support

How does this impact ISX Financial UK Ltd (ISXUK)

The Treating Customers Fairly (TCF) framework is comfortably embedded in ISXUK’s culture and is consistently utilised to ensure our customers receive fair treatment and are satisfied with their experience.

The Duty goes a step further than the TCF framework as it focuses on the process and the impact of a firm’s actions on consumer outcomes.

To ensure compliance with the expectations under The Duty, ISXUK is currently undertaking a review of our products and services, and the value they offer, along with a review of our customer journey to ensure we are providing the necessary support to our customers. This will enable us to determine our position against the rules and make necessary changes where required.

We want to continue putting the interests of our customers at the heart of our culture and purpose.

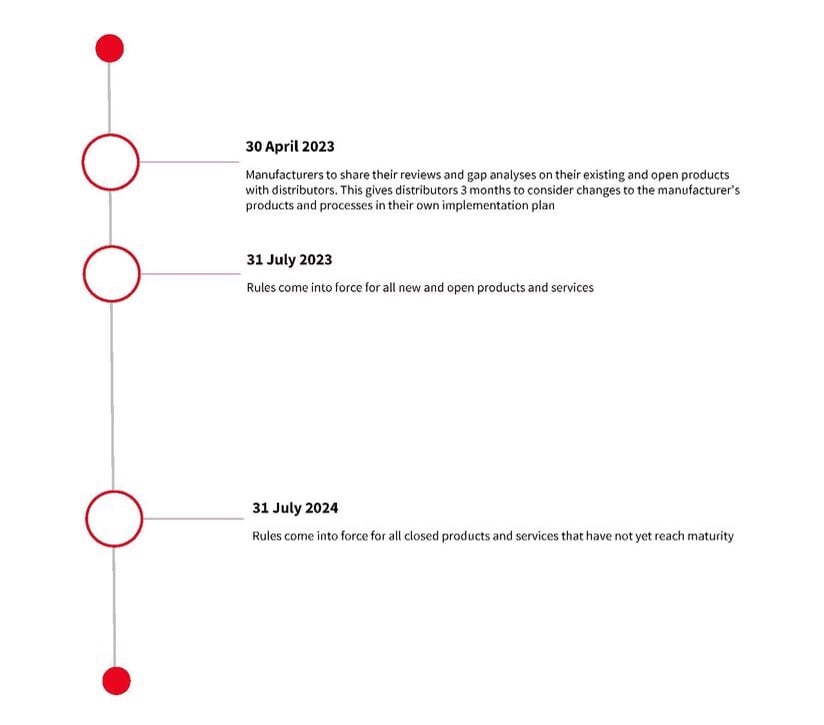

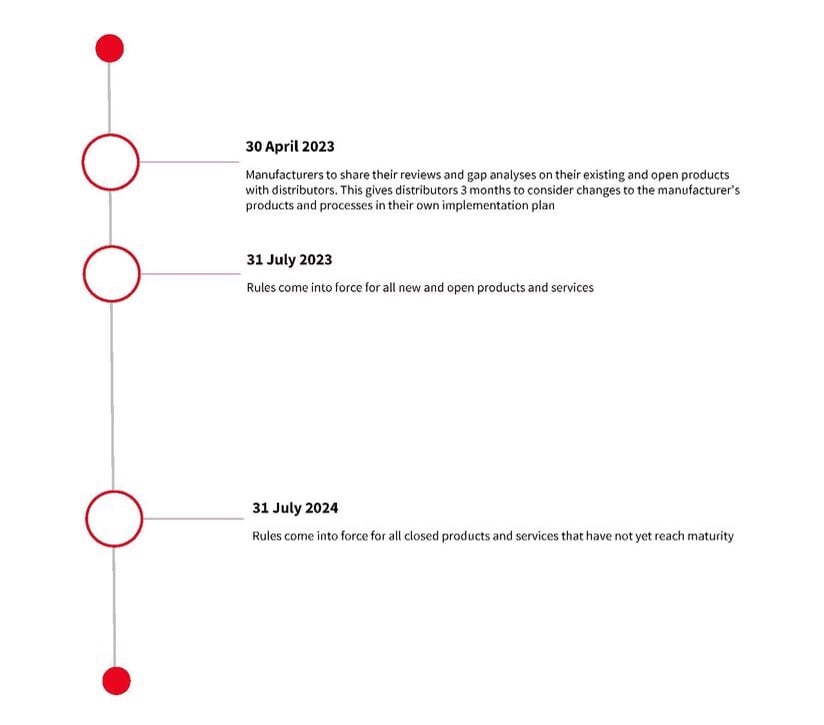

Timeline to implement Consumer Duty:

For more information on the FCA’s guidance on the Consumer Duty please click here.

If you have any queries, please contact our Compliance team at compliance.team@isxfinancial.com